Social security cola calculator

While they are all useful there currently isnt a way to help determine the ideal financially speaking age at which a person between the ages of 62-70 should apply for their Social Security retirement benefits. You must be at least age 22 to use the form at right.

Social Security Benefits Big Cola Increase Due To Inflation Money

Updating the Social Security Benefit Calculator.

. Although the Quick Calculator makes an initial assumption about your past earnings you will have the opportunity to change the assumed earnings click on See the earnings we used after you complete and submit the form below. Social Security website provides calculators for various purposes. Enter your current monthly Social Security SSDI SSI income in the first field labeled Enter Monthly SSSSDISSI Income and the calculator will do the rest.

Use the calculator below to estimate your Social Security income for 2022. So benefit estimates made by the Quick Calculator are rough. Congress enacted the COLA provision as part of the 1972 Social Security Amendments and automatic annual COLAs began in 1975.

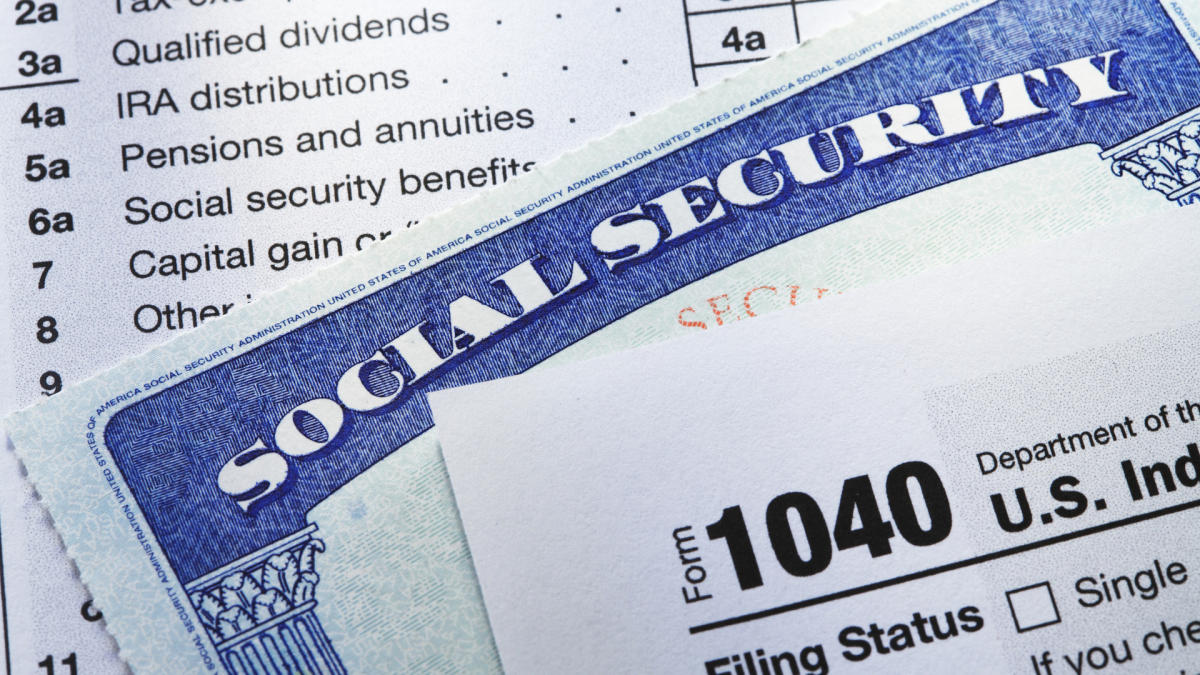

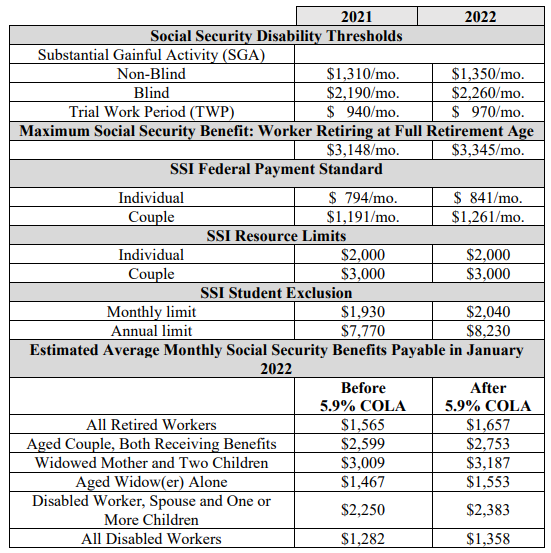

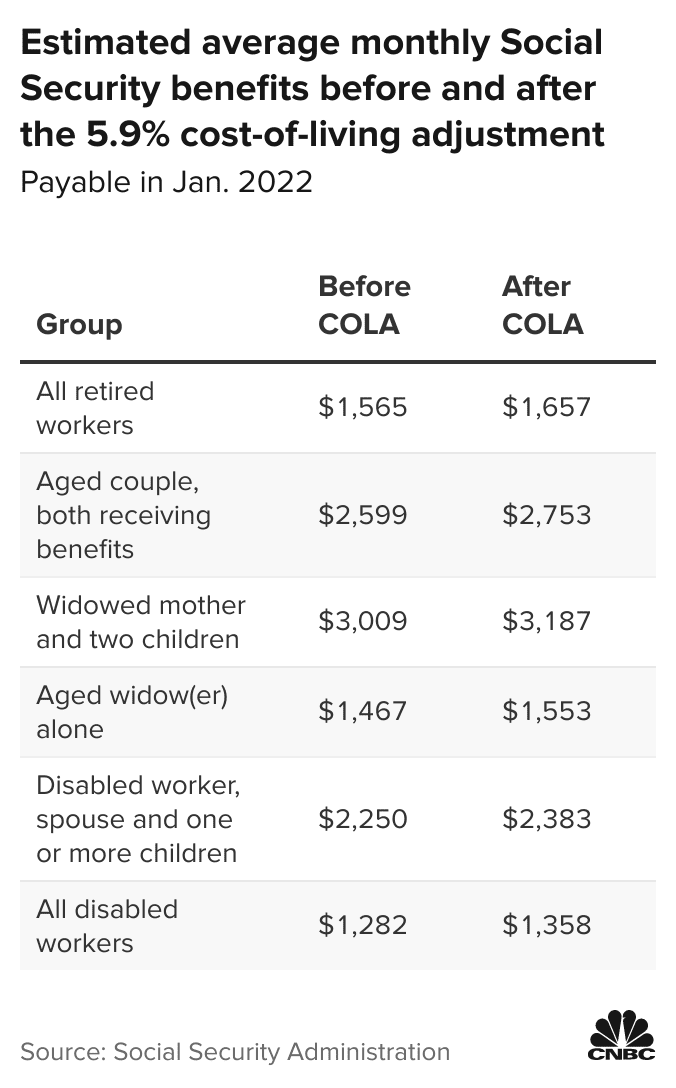

The COLA calculation with the result rounded to the nearest one-tenth of one percent is. Social Security benefits and Supplemental Security Income SSI payments for approximately 70 million Americans will increase by 59 in 2022. The CPI-W figure for June 2021 was 266412.

Learn How Much You Will Get When You Can Get It and More With the AARPs Resource Center. This tool is designed specifically for this purpose. The exact computation however is more complex.

Bureau of Labor Statistics. The Social Security automatic cost-of-living adjustment for December 2021 and the wage-indexed amounts for 2022 were announced in the fall of 2021. This is usually released about the middle of the month.

My Social Security Benefit X 0062 My Social Security Benefit My COLA Adjusted Benefit. A COLA increases a persons Social Security retirement benefit by approximately the product of the COLA and the benefit amount. By finding the percentage and adding it back the new benefit becomes 413649 a month.

That increase is then rounded to the nearest tenth of 1. The COLA is equal to any increase from the third quarter of the past year to the current year. Access your benefits letter online today.

The Bureau of Labor Statistics releases the consumer price index on a monthly basis. The December 2019 COLA which will take effect in January 2020 is 16 percent. By law federal benefits increase when the cost of living rises as measured by the Department of Labors Consumer Price Index for Urban Wage.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Each update reflects numbers for the prior month. When a COLA occurs we increase the PIA as described above and we repeat the steps required to calculate the new benefit amount based on the new higher PIA.

Prior to that date different groups prepare the retirement community by analyzing inflation trends. In order to calculate Social Securitys COLA youll first need to know which inflationary measure published by the US. On average a Social Security benefit for a person filing at 70 years old is around 3895.

Build Your Future With a Firm that has 85 Years of Investment Experience. Junes data for example will be released around July 15. Stay up to date about Social Security.

More information on these automatic adjustments is available. Get the most precise estimate of your retirement disability and survivors benefits. How Social Security Calculates the COLA.

The office gathers the CPI-W measurements. This is the annual cost-of-living adjustment COLA. Also known as COLA it will be a 59 increase over the 2021 amount you receive.

The equation looks like this. Need proof you get Social Security benefits. After a 28 percent cost-of-living adjustment COLA that took effect in 2019 that monthly payment rose to 1461 a difference of 39 a month or 468 a year.

With COLAs Social Security and Supplemental Security Income SSI benefits keep pace with inflation. By law it is the official measure used by the Social Security Administration to calculate COLAs. Choose the right inflationary tether.

Ad Get Your Proof Of Income Letter Online With a Free my Social Security Account. The estimate includes WEP reduction. Beginning in 1975 Social Security.

How to Calculate the COLA for Social Security Benefits. Must be downloaded and installed on your computer. The first payment of the new COLA amount will be in January 2022.

This is 513 percent higher than the average CPI-W for the third quarter of 2020 when the average was 253412 1982-84 100. 268421 - 253412 253412 x 100 59 percent. Ad Discover AARPs Personalized Social Security Calculator and Learn When to Apply.

Early or Late Retirement Calculator. Here is what all of this means for the 2022 COLA based on the June 2021 data. How much is the increase.

The Social Security Administration SSA will announce the official 2023 COLA in October 2022. Before that benefits were increased only when Congress enacted special legislation. Latest COLA The latest COLA is 59 percent for Social Security benefits and SSI payments.

At the end of 2018 the average Social Security monthly benefit for retired workers was 1422. Compute the effect on your benefit amount if you file for early or delayed retirement benefits. The Social Security COLA is calculated based on the three months that make up the third quarter of the CPI-W.

The 20211 version of the Social Security Benefit Calculator can be updated to.

Social Security Could Receive Largest Increase In 40 Years Because Of Cola In 2022 Money Skills Social Security Benefits Retirement Benefits

When Is Social Security Increase For 2023 Announced Cola May Be Most In 40 Years Oregonlive Com

2022 Social Security Cola Final Estimate Confirms It Will More Than Quadruple 401 K Specialist

How Does The Government Calculate How Much My Monthly Social Security Benefits Will Be When I Retire As Usa

Social Security Cola For 2023

Social Security Types Payouts The Program S Future

Will Social Security Change The Way It Calculates Raises Here S Why It Should The Motley Fool

Social Security What Is The Wage Base For 2023

Five Major Changes Coming To Social Security In 2022 Fort Pitt Capital Group

Social Security Cola How To Estimate Your Monthly Payments For 2022

Pin On Retirement

Social Security Benefit Calculation Spreadsheet Spreadsheet Template Track Investments Spreadsheet

Social Security Benefits Cola Could Hit 11 Due To Inflation Money

Could 2023 Social Security Cola Hit 9 Benefitspro

Increase In Social Security Benefits In 2023 How Much Will Recipients Get Silive Com

2023 Social Security Cola Could See Significant Increase Alongside Inflation Benefitspro

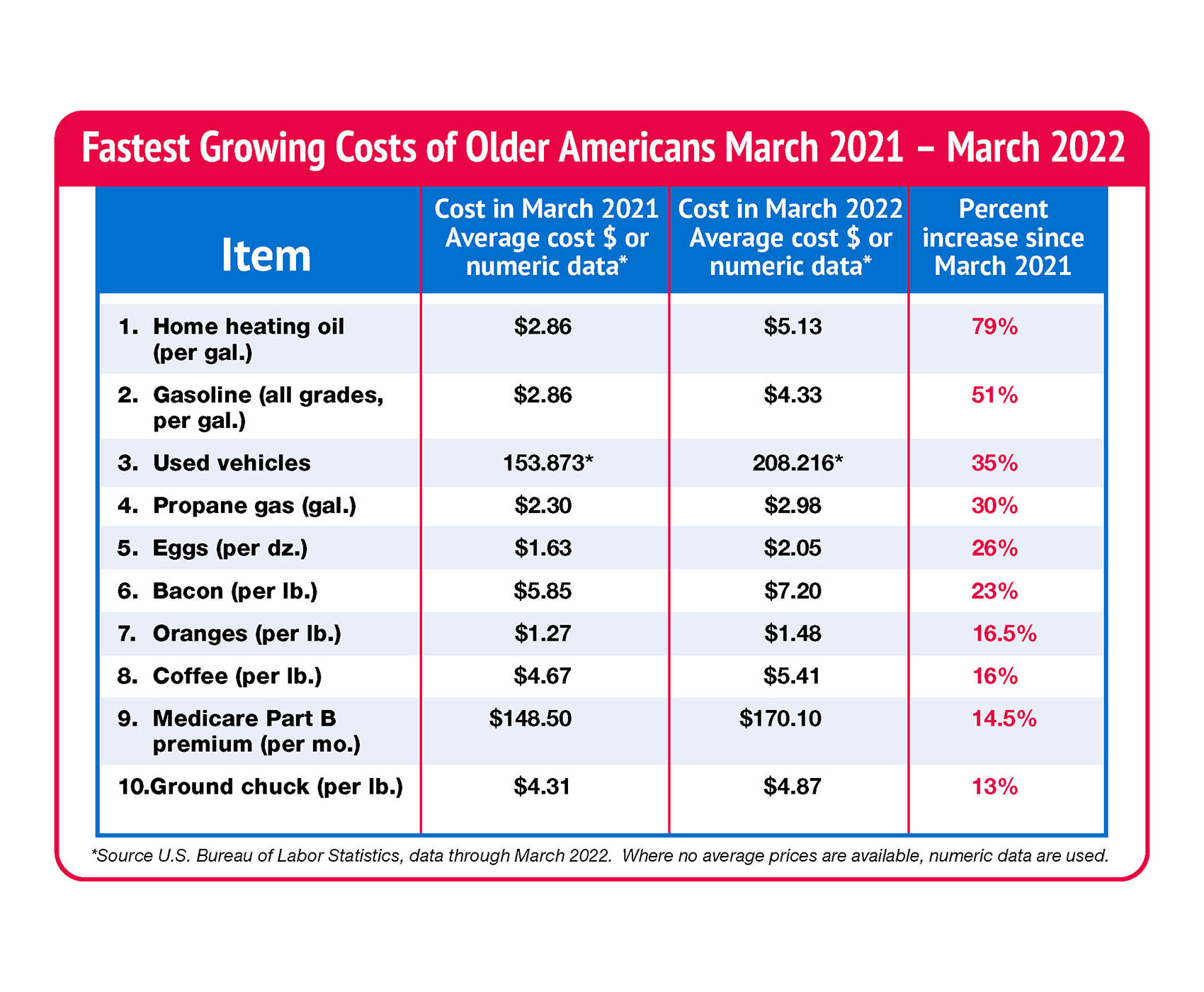

Social Security Benefits Lose 40 Of Buying Power Cola For 2023 Could Be 8 6 The Senior Citizens League